Samsung rolls out another Android 7.0 Nougat beta update for the Galaxy S7 and S7 edge - SamMobile - SamMobile

Android 7 Nougat, Samsung telefonlara ne zaman geliyor? (Samsung Türkiye'den açıklama) - Son Dakika Teknoloji Haberleri | NTV Haber

Galaxy S6 Nougat update manual is out, here are the differences with Android 7 on the S7 - PhoneArena

Galaxy S7 ve S7 Edge için Android 7.0 Nougat güncellemesi yayınlandı - Güncel Eğitim Haberleri - Eğitim ve Öğretmen Haber Sitesi

/cdn0.vox-cdn.com/uploads/chorus_asset/file/3984608/samsung-galaxy-s6-edge-plus-9658.0.jpg)

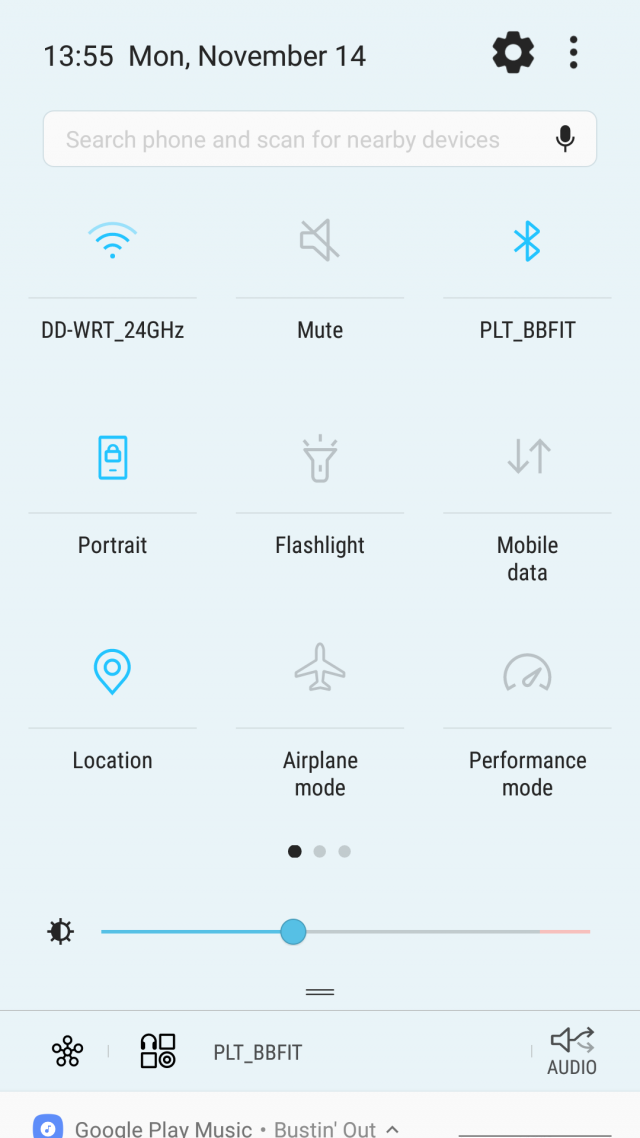

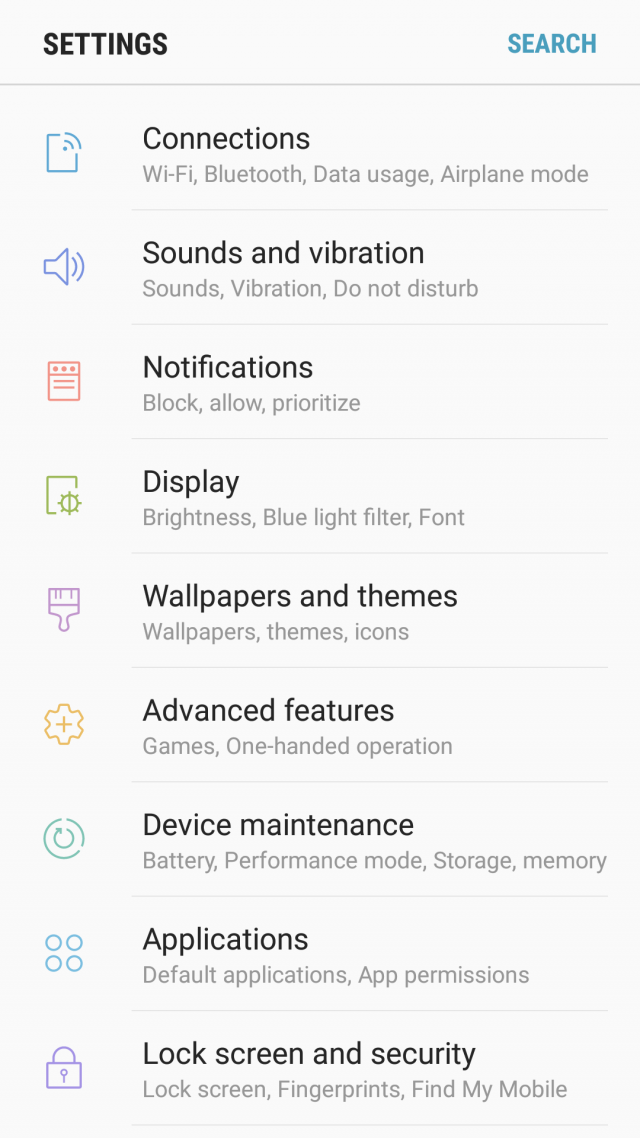

![Review] Samsung Galaxy S7 Edge with Google Android 7.0 Nougat Update – AskVG Review] Samsung Galaxy S7 Edge with Google Android 7.0 Nougat Update – AskVG](https://media.askvg.com/articles/images6/Main_App_Screen_Samsung_Galaxy_S7_Edge_Nougat.png)

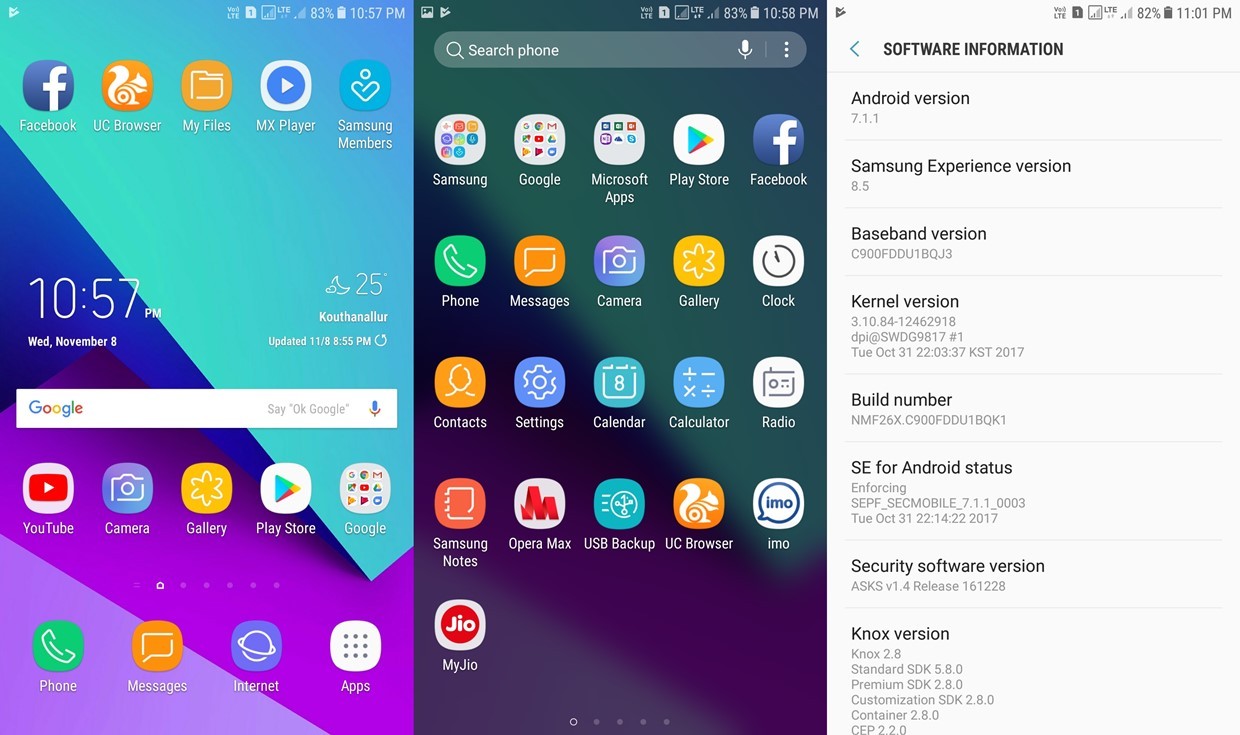

![Galaxy S6 edge running Android 7.0 Nougat [Pictures] - SamMobile - SamMobile Galaxy S6 edge running Android 7.0 Nougat [Pictures] - SamMobile - SamMobile](https://www.sammobile.com/wp-content/uploads/2017/03/s6-edge-nougat-2.png)